The American says « There are two things you cannot hide. One is the death. The second is the tax”. The death depends on each person’s destiny, but the tax – all the people have profits have to pay it before the 15th April every year. When you declare your taxes, if you work for other people, you will receive the W-2 or 1099 with a clear state of how many you have earned during the year. So what are the differences of the two? And which one will be better for you?

W-2 and 1099

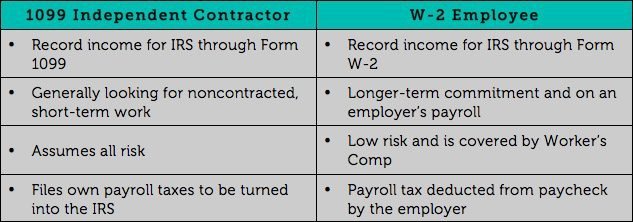

Basically, everyone that receives W-2 already has his/her tax deductive after each payment, and after declaration of the taxes, it is most likely you will receive some of that money back. Those receive 1099 the tax deduction has not yet made after each payment. Thus, when you declare your taxes, you will have to pay to fulfill your responsibility with the U.S.

However, this is not just that simple. The paper you receive also reflects your employment: a salaried employee or an independent contractor, working on contracts. A salaried employee will benefit a certain rights that an independent contractor will not.

What are the rights ?

First of all, all the salaried employees must be paid at minimum wage or more. Currently the minimum wage in the U.S. is $7.25 / hour or $2.13 / hour if you work in a regular sector which you can receive tip from customers. Depending on the state and city you work, the minimum wage could be higher than that specified by the governor or the council. For example, the minimum wage in California is $ 8 per hour and it will increase to $ 9 per hour in July this year. In Northern California, San Jose's minimum wage is $ 10.15/ hour, and San Francisco's city is $ 10.74 / hour.

Secondary, hourly pay workers must be paid overtime for more than eight hours in a day or 40 hours in a week in order not to be exploited. In addition, a formal employee has the right to rest and to rest. In California, employees must have 10 minutes of paid vacation after every four hours of work and 30 minutes of unpaid leave after every five hours of work.

In addition, employers are responsible for paying some funds to their employees. All firms, companies, and salon owners must pay half the Social Security tax for each employee, Unemployment Insurance and Workers' Compensation. And especially in Cali, they also pay to State Disability Insurance.

By listing out as above, it is to show that the official employees are entitled to many legal rights while those contractors are not protected at all. "Independent contractor" is not guaranteed a minimum wage, no overtime allowance, no guaranteed vacation or meal leave, and no employer-provided insurance coverage for all types of insurance in case he or she loses the job or loses the capacity of working for a while. The independent contractors' rights, if any, must be negotiated in the contract between the employee and the tenant.

Thus, because of this reason, there are many employers deliberately misrepresent the types of contract to their workers, treating their employees as independent contractors to evade responsibility towards the employees with the above benefits.

So why does the laws seem not to protect the rights of contractors, and why do some people choose to work in this way? Generally speaking, contractors are not protected by the law because independent contractors themselves are small businesses, and they sell their knowledge and skills to many different clients. A lawn mower can cut grass for many places; a brick lining professional can lining brickwork for many different houses; a manicurist can do nails in different salons; a taxpayer can file tax returns to many different people.

In these cases, the contractors have the right to negotiate the payment for each job, rights to accept or reject the job. They have the right to change and no one “owns” them. They work under contract and no one has right to manage them, as long as they work in line with the contract. Furthermore, independent contractors must be paid for the results, not their time. That is, if they finish a job fast, they can make more money.

Another advantage is that the contractor can assign the job to someone else, as long as that the job is completed as promised. A lawn mower can have workmen work for him, no need to cut the lawn himself. An independent manicurist may not go to the salon and ask for another person in the profession to replace him/her for a few days while the salon owner cannot do anything; since the owner only has the right to manage employees, not the right to manage the contractor Because they have full autonomy and negotiating powers, the law does not provide much protection for independent contractors.

Therefore, the type of work influences the rights. The two types of official employee and independent contractor have their own advantages and disadvantages. Employees must be managed, but given basic rights by law. Independent contractors must be self-supporting, not protected by law, but have autonomy. Suffering for the Vietnamese is that apparently many Vietnamese here do not know the differences. It is popular that many Vietnamese work as independent contractors without the legal rights as all salaried employees, but let the employers control and manage them as their employees.

We hope that everyone will check and act on the own’s rights.